Estimate my taxes

The California Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming.

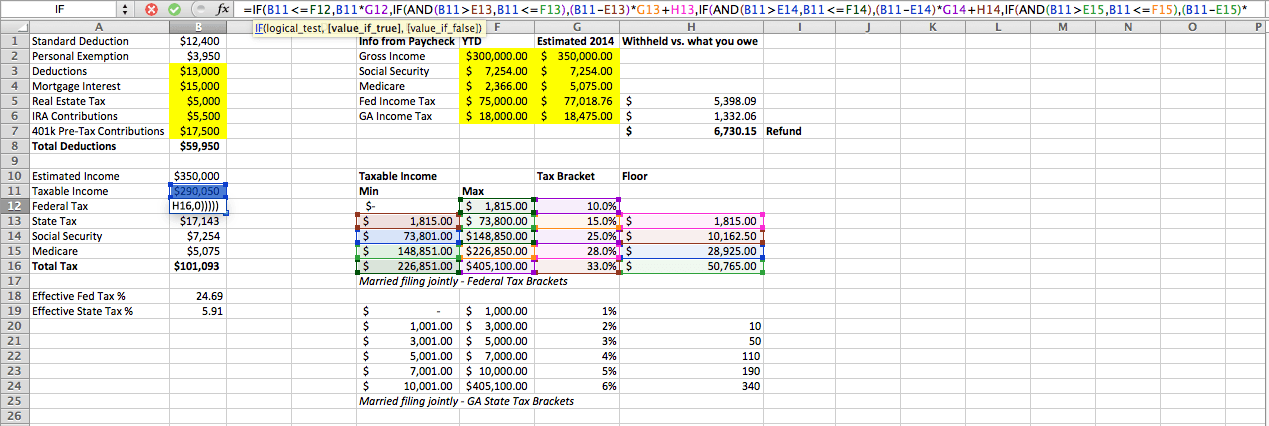

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as.

. Each state also has different tax forms and rules that determine how much you have to pay. Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022. Are calculated based on tax rates that range from 10 to 37.

Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income. 15 Tax Calculators 15 Tax Calculators. Start the TAXstimator Then select your IRS Tax Return Filing Status.

The tax calculator can be used as a simple salary calculator by entering your Annual earnings choosing a State and clicking calculate. Estimating a tax bill starts with estimating taxable income. Start the TAXstimator Then select your IRS Tax Return Filing Status.

You have nonresident alien status. When figuring your estimated tax for the current year it may be helpful to use your income deductions and credits for the prior year as a starting point. Find out how much your salary is after tax Enter your gross income Per Where do you work.

Estimate your tax withholding with the new Form W-4P. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

Use your prior years federal tax. You may be able to annualize your income and make an estimated tax payment or an increased estimated tax payment for the quarter in which you realize the capital gain. Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55000 Federal.

Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable. It is mainly intended for residents of the US. You would have to.

Income taxes in the US. And is based on the tax brackets of 2021 and. You can also create your new 2022 W-4 at the end of the tool on the tax.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. In a nutshell to estimate taxable income we take gross income and subtract tax deductions. This is great for comparing salaries reviewing how.

Use the IRSs Form 1040-ES as a worksheet to determine your estimated taxes. How Income Taxes Are Calculated. - You expect to.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. The Federal or IRS Taxes Are Listed. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

If any of the following apply to you during the year you may have to pay quarterly taxes.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Rate Calculator Top Sellers 55 Off Www Ingeniovirtual Com

Excel Formula Income Tax Bracket Calculation Exceljet

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Net To Gross Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Self Employed Tax Calculator Business Tax Self Employment Self

How To Calculate Income Tax In Excel

How To Calculate Sales Tax In Excel

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Tax Rate Calculator Top Sellers 55 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel